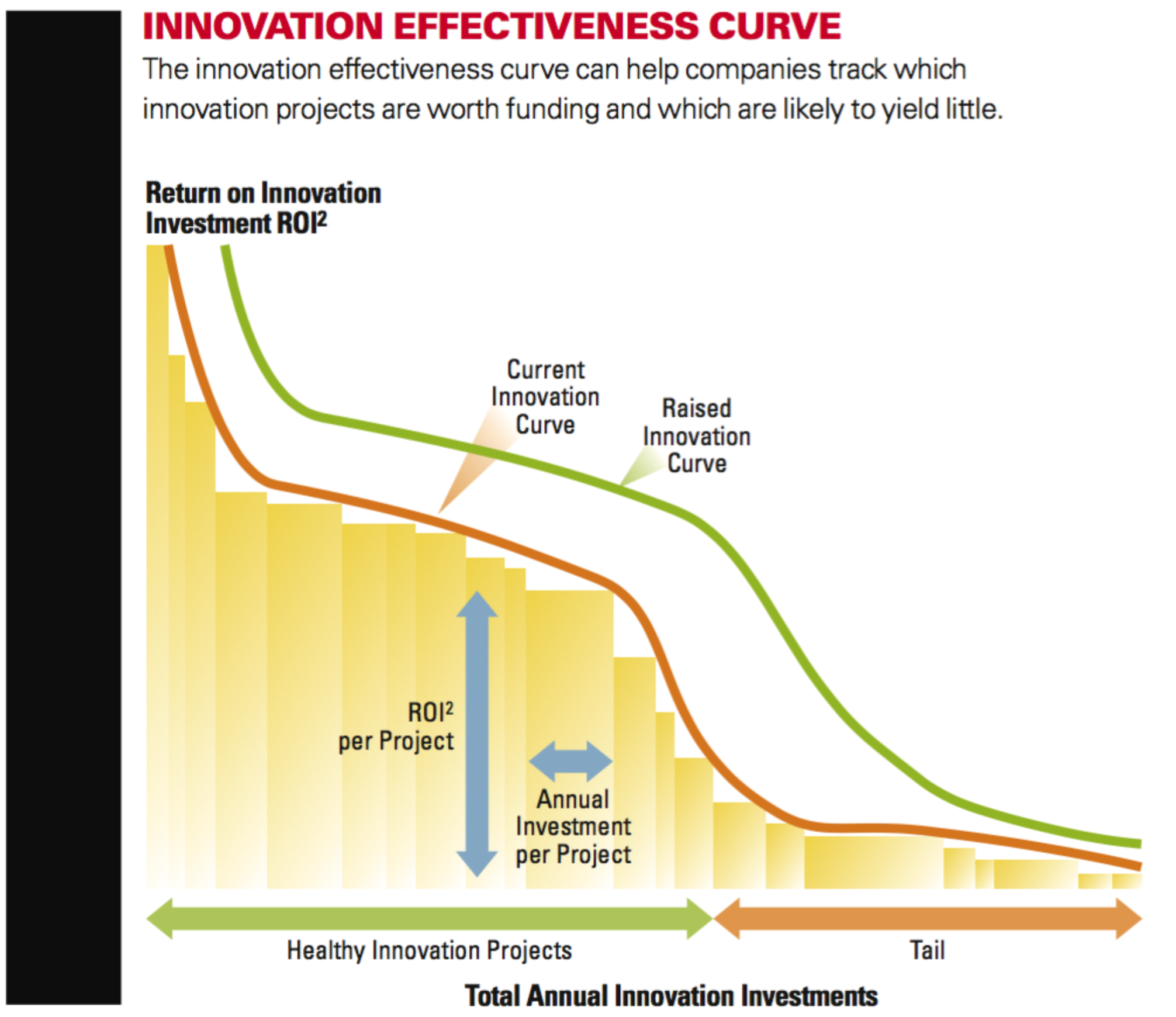

In an innovative enterprise, it is always a challenge to look at different trends, create mini experiments that create learnings, and if we are lucky, mature these ideas into products that customers love. This has traditionally been done by creating different innovation metrics which are tracked and used for making go-no go decisions. Most of the time these metrics are soft as putting a dollar value on an investment return is incredibly hard. For example, how much is an ROI on an investment in battery technology that Apple made that eventually went into creating the first iPhone. Lately there has been a case that's made which suggests looking at investments in innovation as investment in options rather than a static financial model which will pay off after a certain period of time. I think this has real value since being an engineer even though I value soft metrics, I like the rigor brought about by rigorous mathematical modeling.